BMO Digital Banking

With BMO Digital Banking, it's easy to do your banking online, anywhere, anytime. Despite how much life has changed recently, you can still safely and easily manage your banking online or on your mobile device footnote 1. All you need to do is sign up for BMO Digital Banking to get started.

We designed our features with you in mind

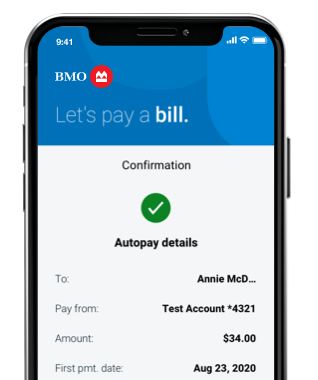

- Set up automatic payments and let us help you manage your deadlines

- Schedule payments in advance, so you never miss a due date

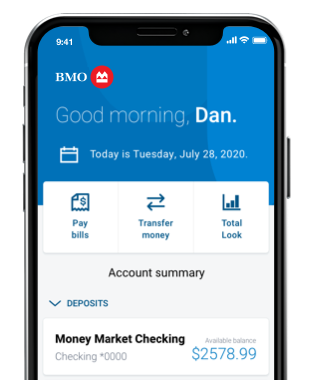

- Analyze your spending habits with our simple account statements and money management tools

- Manage all your accounts in one secure location – even if they’re not with us

- Create a personalized budget in minutes to stay on top of your financial goals

- Track your spending and categorize transactions automatically, so you know exactly where your money goes

- Use BMO Savings Goals to set up, track and reach financial milestones

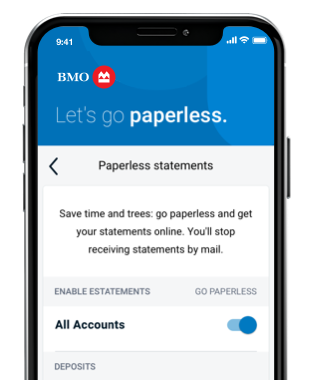

- Access your bank statements online in one central location, any time you like

- Update your account preferences online to switch to paperless statements

- Switch all of your accounts to paperless statements, or choose specific accounts

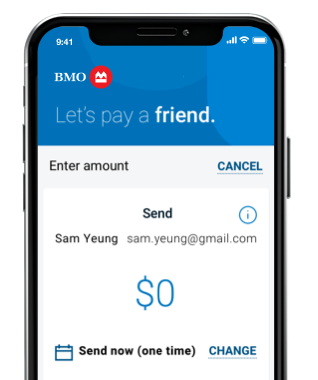

- Send, request and receive money from friends and family with Zelle® footnote 4 a fast way to send money – all with no user fees from us

- Move money between your BMO accounts quickly and easily with internal transfers footnote 5

- Transfer money to and from external accounts for free with External Transfers

- Skip the trip to the bank and deposit checks directly from your smartphone with Mobile Deposit footnote 6

- Save on interest and pay off credit cards quickly with a credit card balance transfer.

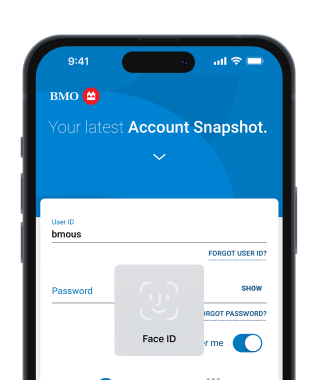

The BMO Digital Banking app puts control of your money in the palm of your hand footnote 1.

- Quickly and securely access your account with Touch ID® and Face ID®

- With Mobile Deposit footnote 6, skip the branch or ATM. Deposit checks just by taking a picture of them

- Get immediate access to the funds from an eligible check with FundsNow, a feature on the BMO Digital Banking app

- Make payments by adding a BMO credit or debit card to Apple Pay, Android Pay or Samsung Pay

- Manage your mobile alerts to choose what account activity you’d like to be notified about

- Get no-fee, no-impact access to your credit score anytime with BMO CreditView, available on mobile and desktop devices

Your security is our priority

We protect your assets and information with multiple security features:

- Best-in-class firewall and email strengthening programming

- Industry leading security software

- Our Digital Banking Guarantee footnote 3 ensures you’ll never pay for unauthorized transactions

- Learn more on our Security Center

Frequently Asked Questions

An External Transfer is a transfer of money between your BMO Personal or Business checking, or money market account and an eligible External Account at another U.S. financial institution. External Transfers will also allow you to transfer funds from an External Account to an eligible BMO mortgage, line of credit or other Personal or Business loan account that you have with us. External Transfers are not currently available for BMO savings accounts.

You can make an External Transfer if:

- You are 18 years of age or older

- You have a street address on file (P.O. Boxes are not eligible)

- You have a BMO Personal or Business checking, savings or money market Account or an eligible BMO mortgage, line of credit or other Personal or Business loan Account

- You have an eligible External Account at another U.S. financial institution.

No. We do not charge a fee to make an External Transfer. However, fees may apply if an External Transfer overdraws your Account. You should also check with the financial institution where you have your External Account to see what fees and charges it may charge you.

Zelle® is a fast and easy way to send and receive money and split the cost of expenses with almost anyone who has a bank account in the U.S. footnote 4 You can enroll to start sending and receiving money with just an email address or U.S. mobile phone number.

Zelle® is super convenient, but it’s a good idea to only use it with people you know and trust.

- Zelle® is a great way to send and receive money and/ or split the cost of expenses with people you know. Pay your babysitter from your smartphone rather than heading to an ATM, split the cost of a restaurant bill between friends, and receive money you’re owed from a family member.We don’t recommend using Zelle® to send money to a person you haven’t met before or if you aren’t sure you’ll get what you paid for (like if you’re buying something from an online bidding site).Neither BMO nor Zelle® offers a protection program for any authorized payments you make using Zelle®.

Your mobile deposit limits are based on the type of accounts you have. You can find your weekly total combined deposit limit for all your accounts when you access the “Deposit a Check” feature on the mobile app, then select “To Account” and click the info icon in the deposit amount field displayed on the application screen.

Eligible Accounts include BMO personal or small business checking or money market checking accounts.

We do not charge a fee to make a standard Bill Payment. We do charge a fee for Expedited Payments. The fee will be disclosed to you at the time you set up the Expedited Payment. The amount of the fee will vary by whether the Expedited Payment is made by ACH payment or by overnight mail. In addition, fees may apply if a Bill Payment overdraws your Account.

To access Total Look, log in to BMO Digital Banking, select Total Look, then Get Started, That’s it! You are now ready to start adding your accounts and using Total Look.

It’s easy to add accounts in Total Look. Simply select Total Look, then select Link Account and either enter the account you wish to add or select from a list of popular accounts. Enter your online login information for the account being added and select Link Account. Then, simply select Continue and you’re all set! The account will instantly appear within Total Look. When adding non-BMO accounts, the data that displays in Total Look is provided by third parties and is read only.

FundsNow gives you immediate access to the funds from an eligible check if you’re depositing on a Business Day before 8 p.m. Central Time (CT). You’ll be given the option to choose FundsNow when you’re using Mobile Deposit if your check and account are eligible.

Checks deposited after 8 p.m. CT or on a non-Business Day will be immediately available for cash withdrawal or debit card purchases; however, those funds will not be available to complete certain transactions such as covering overdrafts and paying checks until the next Business Day.

Explore the frequently asked questions (FAQs) in Spanish.

Yes, the fee for FundsNow is 2% of the deposit amount for checks $100 and over, or $1 for checks of $99.99 or less.

Not all checks are eligible to receive the FundsNow service. If you don’t see the FundsNow option when depositing a check using the BMO Digital Banking app, that means that either your check is ineligible or the account you’re depositing into is ineligible. Checks of less than $20 are never eligible for FundsNow.

If you have more questions, you can view all FAQs.

Have more questions?

Find a branch

Locate a BMO branch near you.

Call us

Give us a call 24 hours a day, 7 days a week.

Footnote 1 detailsMessage and data rates apply. Contact your wireless carrier for details.

Footnote 2 detailsPlease visit www.bmo.com/en-us/security/ for more details.

Footnote 3 detailsCertain conditions and limitations apply. The Digital Banking Guarantee applies to personal accounts only. Please see the BMO Digital Banking Agreement found at bmo.com/en-us/legal/ for details.

- Footnote 4 detailsU.S. checking or savings account required to use Zelle®. At BMO we require you to enroll in a checking account to use Zelle®. Transactions between enrolled users typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle®. Zelle® should only be used to send money to people and businesses you trust. Zelle® does not offer protection for authorized payments, so money you send may not be recoverable. For details, see the BMO Digital Banking Agreement found at bmo.com/en-us/legal/.

Footnote 5 detailsIf you make an Internal Transfer on a weekend or holiday, we'll credit the payment the same day, but we'll post the payment on the next Business Day.

6Mobile Deposit is available using the BMO Digital Banking app. This service may not function on older devices. Users must be a BMO Digital Banking customer with a BMO account opened for more than 5 calendar days. Deposits are not immediately available for withdrawal. For details, please see the BMO Digital Banking Agreement found at bmo.com/en-us/legal/.

Android is a trademark of Google Inc.

Android, Google Play, and the Google Play logo are trademarks of Google Inc.

- Apple Pay is a trademark of Apple Inc.

App Store is a service mark of Apple Inc. Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries.

CreditView and its features, Score Simulator and Credit Education, are provided by TransUnion for informational purposes only. You should consult with your own financial team for more information about current credit score.

CreditView is a trademark of TransUnion LLC.

Samsung and Samsung Pay are trademarks of Samsung Electronics Co., Ltd.

- Touch ID® and Face ID® are trademarks of Apple Inc.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.